Open A Free Demat Account Today

Get StartedDocuments To Be Kept Handy

- PAN Card

- Cancelled Cheque

- Latest 6 month Bank Statement (Only for Derivatives Trading)

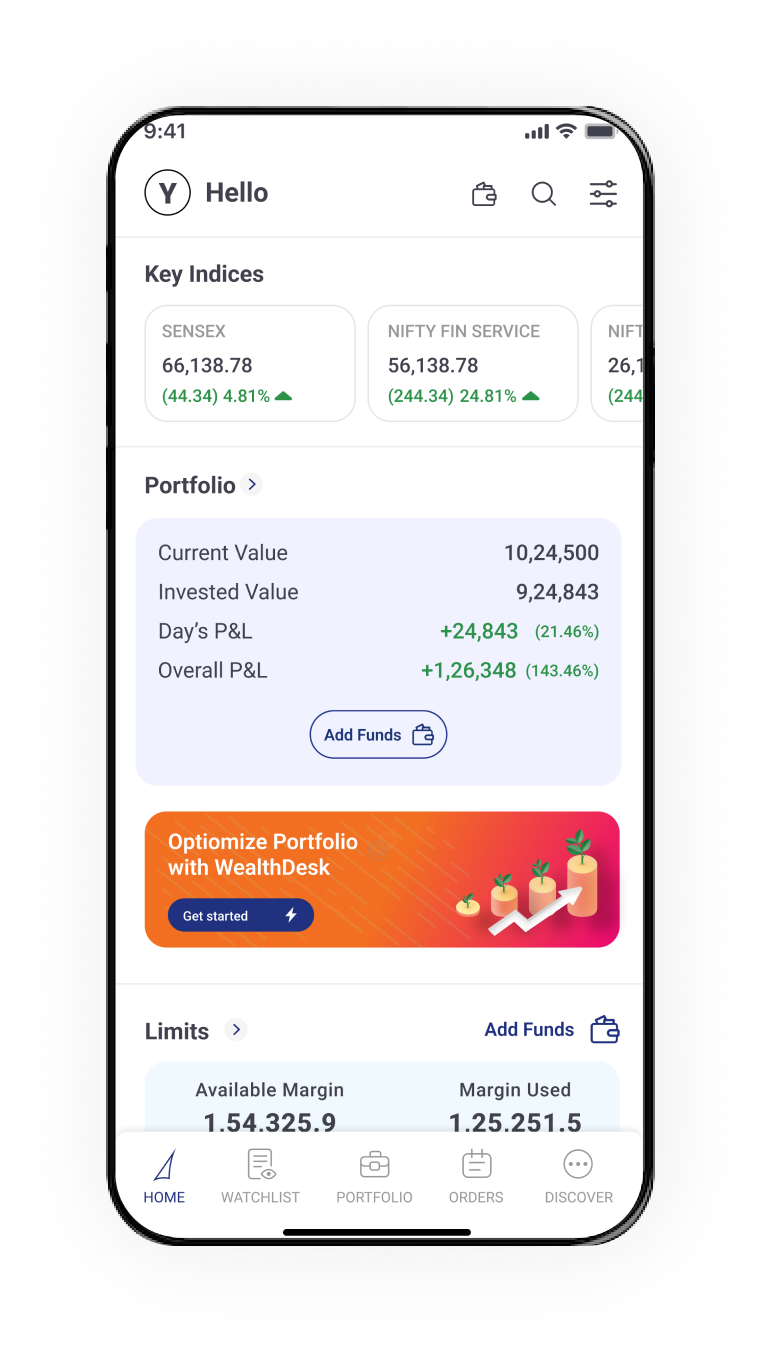

Investing in Stocks Made Easy

High Quality Investment Ideas

Call n Trade for Free

Dedicated Relationship Manager

- Stocks -

Investing in Stocks is a popular way of owning a “share” of profits in your favourite listed companies. Investors can generate long term wealth through Dividends and growth in stock price. With a wide array of stocks to choose from, investing in the right ones can help you achieve financial freedom.

With JM Financial Services investing in stocks is simple and efficient with access to real time market data, high quality research, powerful investing tools and personalised service.

You can choose to:

- Invest Long Term and pay full buy value and get shares in your Demat account

- Invest Systematically with Equity SIP in any market condition

- Invest and Sell with our Intraday product and make most of daily market opportunities

- How does Investing in Stocks help you? -

Better Returns

Aim for better returns

than traditional avenues

Higher Liquidity

Higher Liquidity to sell anytime

& get cash into your account

Dividend Income

Earn income from

company earnings or profits

Flexible Investment Option

Invest in the quantity or value

of the stock as per your need

- Why Invest in

Stocks? -

- Potential for better returns than traditional avenues

- Income through Dividends from company profits

- Higher Liquidity to sell anytime and get cash into your account

- Get a share in the profits of the companies you invest in

- Long-term Wealth Creation

- The JM Financial Services

Advantage -

50 years of Expertise

Free Stock Recommendations

Advanced Order Placement

Pre-apply to IPOs

Research & Recommendations across 25+ Sectors

Equity Ninja – Expert picked Stock baskets

Dedicated Relationship Manager

- Get Started Now -

Sign Up

Open a free trading account online or with assistance from our Relationship Managers

Research

Use our advanced research to find the best stocks suited for your goals

Invest

Buy stocks effortlessly & start investing

- How to Select Good Stocks for Investment? -

A combination of Fundamental analysis to find out the true value of stocks and Technical analysis to study price movements, is essential to choose a good stock. For long-term investors the company’s growth prospects and valuation is to be considered, while short-term traders should focus on recent price movements.

- Company Analysis: Thoroughly review a company’s financial books and future prospects to identify the potential of a stock.

- Industry Outlook: The sector or industry in which the company operates plays a pivotal role in predicting a stock's returns and companies in booming sectors might offer better returns.

- Historical Performance: Past performance provides insights for future results, though it may not be a sure shot indicator of success. With careful technical analysis, understanding movement of the company’s stock price can help predict future price movement.

- Management Quality: Researching the leadership and management team’s track record and strategic vision is very important for identifying a company's growth.

- Valuation Ratios: Ratios like Price-to-Earnings (P/E), Price-to-Book (P/B), and Debt-to-Equity can assess a company's valuation and can help determine if the stock is overpriced or undervalued.

- Growth Potential: Companies with clear growth strategies and expansion plans can be promising for long-term equity investments.

- Diversification: However appealing a stock may seem, avoid putting all your funds into it. Diversifying across stocks can help navigate portfolio risk.

- Consult Experts: Consult with financial experts is crucial, espeacially for new investors. JM Financial Services offers solid research in over 25 sectors & 200+ companies.

Pro-Code to Investing

Customised

Dashboard

Dashboard

Smart

Watchlist

Watchlist

Option

Slicing

Slicing

Download Now

Download

Now

Now

- Our Customers Love Us -

- Frequently Asked Questions -

Account Opening Terms & Conditions

- The Free Demat & Broking Account ("Welcome Offer") is being offered by JM Financial Services Ltd. ("JMFS") to new clients.

- *Tariff Structure for DP Services will be applicable as per the scheme/plan opted for.

- Execution of trades shall be governed as per the Terms and Conditions and KYC policies and Procedures agreed at the time of account opening and as amended from time to time.

- The Welcome Offer is not available/applicable to any employee of JM Financial Group and Business Affiliates ("Franchisees") of JMFS and the clients who are opening account with JMFS through their Franchisees.

- The Welcome Offer is subject to terms and condition as prescribed by JMFS. Please read the same carefully before opting for the Welcome Offer.

- JMFS reserve the rights to modify/amend the welcome Offer and its terms and conditions or withdraw the Welcome Offer at any time before the completion of the validity period by giving 15 days’ notice and the same shall be binding on the client.

- The brokerage will not exceed the SEBI prescribed limit.

- Demat cum trading account with JMFS will be opened after all the procedures relating to IPV and client due diligence are completed.

- In case of any dispute, the decision of JMFS management shall be final and binding on all the parties concerned.

- The above information is only for consumption by the client and such material should not be redistributed.

Investments in securities Market are subject to market risk, read all the related documents carefully before investing.

Declaration

- I understand that my account would be opened as per name appearing in Income Tax records and the same would be activated after all procedure relating to client due diligence in accordance with regulatory guidelines is completed.

- I authorize JMFS to contact me and send promotional communication via SMS & Whatsapp even though I may be registered under National Do Not Call Registry established under the Telecom Unsolicited Commercial Communications Regulations, 2007 or registered or may be registered under the National Customer Preference Register established under new regulations viz. the Telecom Commercial Communications Customer Preference Regulations, 2010.

- I authorize JMFS to undertake my KYC online through KRA/Aadhaar/Digi locker based on authentication of opening Trading and Demat account with JMFS.