Open A Free Demat Account Today

Get StartedDocuments To Be Kept Handy

- PAN Card

- Cancelled Cheque

- Latest 6 month Bank Statement (Only for Derivatives Trading)

Invest in Fixed Income Products

Regular Income Stream

Tax Efficiency

Lower Volatility

- Why choose Fixed Income products -

- Predictable returns and stability of portfolio

- Portfolio diversification and risk adjustment

- Hassle free investing process

- Regular Interest Income

- How does Corporate FD work? -

A Corporate Fixed Deposit (FD) is similar to a bank FD but instead of depositing your money with a bank, you lend your money to corporations or non-banking institutions. In a corporate FD, you choose an issuer based on their credit rating and track record and decide your investment amount and period. The issuer on its part pays you a fixed interest rate for the duration of the fixed deposit at predetermined intervals. The interest can either be in the form of simple interest or compound interest. Similar to a bank fixed deposit, you get your principal amount and accrued interest if any at the time of maturity.

- Why invest in Corporate FDs? -

Higher Interest Rates

Safe & Secure Investment

Portfolio Diversification

More than 150 investment opportunities to choose from

- Fixed Income Instruments to choose from -

- Company Fixed Deposits

- Non-Convertible Debentures

- Government of India Bonds

- 54 EC Capital Gains & Infrastructure Bond

- Senior Citizen Savings Scheme

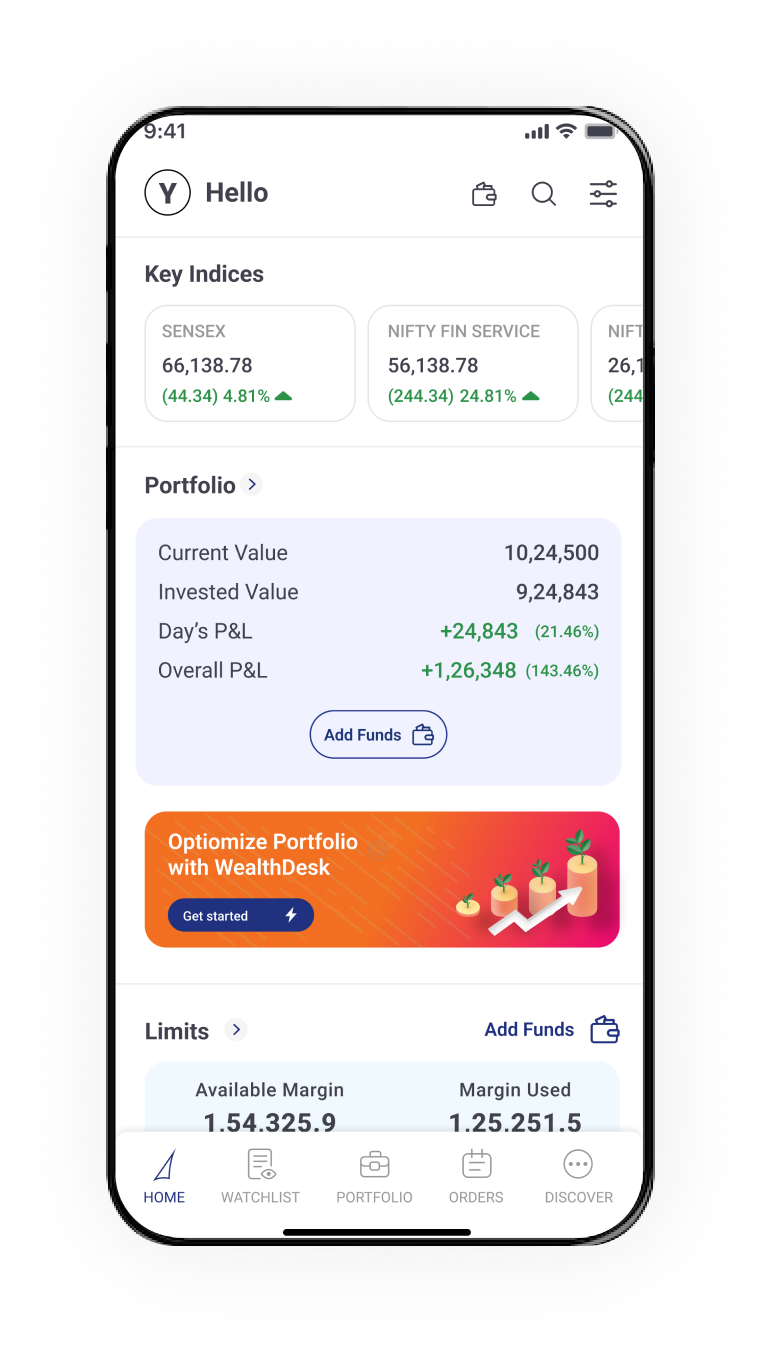

Pro-Code to Investing

Customised

Dashboard

Dashboard

Smart

Watchlist

Watchlist

Option

Slicing

Slicing

Download Now

Download

Now

Now

- Our Customers Love Us -

- Frequently Asked Questions -

Account Opening Terms & Conditions

- The Free Demat & Broking Account ("Welcome Offer") is being offered by JM Financial Services Ltd. ("JMFS") to new clients.

- *Tariff Structure for DP Services will be applicable as per the scheme/plan opted for.

- Execution of trades shall be governed as per the Terms and Conditions and KYC policies and Procedures agreed at the time of account opening and as amended from time to time.

- The Welcome Offer is not available/applicable to any employee of JM Financial Group and Business Affiliates ("Franchisees") of JMFS and the clients who are opening account with JMFS through their Franchisees.

- The Welcome Offer is subject to terms and condition as prescribed by JMFS. Please read the same carefully before opting for the Welcome Offer.

- JMFS reserve the rights to modify/amend the welcome Offer and its terms and conditions or withdraw the Welcome Offer at any time before the completion of the validity period by giving 15 days’ notice and the same shall be binding on the client.

- The brokerage will not exceed the SEBI prescribed limit.

- Demat cum trading account with JMFS will be opened after all the procedures relating to IPV and client due diligence are completed.

- In case of any dispute, the decision of JMFS management shall be final and binding on all the parties concerned.

- The above information is only for consumption by the client and such material should not be redistributed.

Investments in securities Market are subject to market risk, read all the related documents carefully before investing.

Declaration

- I understand that my account would be opened as per name appearing in Income Tax records and the same would be activated after all procedure relating to client due diligence in accordance with regulatory guidelines is completed.

- I authorize JMFS to contact me and send promotional communication via SMS & Whatsapp even though I may be registered under National Do Not Call Registry established under the Telecom Unsolicited Commercial Communications Regulations, 2007 or registered or may be registered under the National Customer Preference Register established under new regulations viz. the Telecom Commercial Communications Customer Preference Regulations, 2010.

- I authorize JMFS to undertake my KYC online through KRA/Aadhaar/Digi locker based on authentication of opening Trading and Demat account with JMFS.