Where Wealth Meets Purpose

We live in a limitless world of opportunity today where Wealth creation is not just passively driven by the markets It is driven by You - with vision and dedication and the right investment partner who puts you in the driver's seat.

At JM Financial Wealth, we bring a refined, boutique approach to the way your wealth is managed. Our role is to quietly orchestrate excellence behind the scenes — combining comprehensive research, personalised strategy and curated access to bespoke solutions. The result is a wealth journey where clarity replaces noise, opportunity finds you first, and your financial world is designed to grow with purpose.

Why Choose JM Financial Services

We Bring To You The Bigger Picture

Wealth Management

Bespoke strategies that shape your wealth, your way.

Capital Markets

Equity Market Opportunities. Sharp insights. Seamless execution.

Fixed Income Solutions

Stable, curated fixed-income ideas for measured, long-term confidence.

Managed Products

Expertly managed solutions built to compound strength over cycles.

A Legacy of Trust & Expertise

JM Financial Group stands at the helm of India’s financial landscape—defined by integrity, insight, and disciplined innovation. With a heritage of excellence and a diversified service model, we deliver end-to-end solutions across investment banking, wealth management, institutional equities, research, trading, and asset management.

Enduring Reputation

For decades, JM Financial Group has earned its place as a trusted institution—respected for its judgment, admired for its consistency, and relied upon by clients across generations.

Holistic Financial Solutions

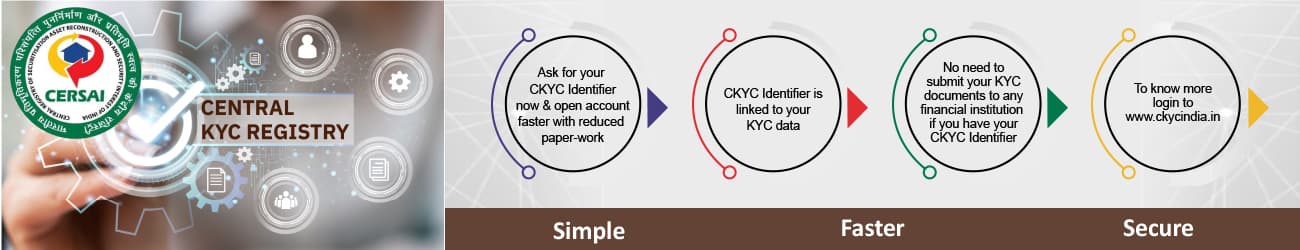

Our integrated platform provides seamless access to a full spectrum of financial services, offering clients a unified, high-quality experience under one distinguished brand.

Commitment to Excellence

Integrity, transparency, and innovation anchor everything we do. Our pursuit of superior outcomes defines our culture, shapes our decisions, and reinforces our commitment to every client we serve.

Our Clients Love Us

Proven Performance. Quantified Trust.

Decades of delivery, billions in assets, and thousands of relationships — all measured, all meaningful.

of Broking Experience

Presence in Cities

Network of Branches

Active Financial Distributors

No. of Clients

Equity Average Daily Volume

Assets Under Mangement (AUM)

No. of Franchisees

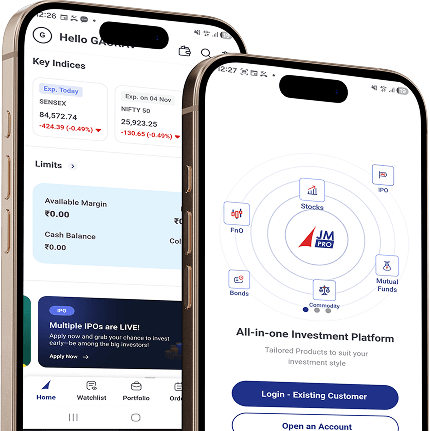

Open A Free Demat Account Seamlessly

Open A Free Demat Account Seamlessly