SIP Calculator

Loading chart...

Newbie investors may think that Systematic Investment Plan (SIPs) and Lumpsum Mutual Funds are the same. However, SIPs are a method of investing in mutual funds at regular interval, the other method being ‘Lump sum (One Time investment) in mutual funds’. A SIP calculator is a tool that helps you arrive at the returns you can expect when investing in such assets. SIP is a process of investing a fixed sum of money in mutual funds at regular intervals - usually weekly, quarterly, or monthly. Investing via SIPs in mutual funds is becoming a popular investment choice for new age investors.

A SIP calculator is a simple tool that ascertains the returns on mutual fund investments made through SIP. These calculators give potential investors an estimate of the returns on their mutual fund investments. However, the actual returns earned on mutual fund scheme may vary, depending on several factors.

A SIP calculator does not provide information with respect to the exit load or expense ratio (if any) on the mutual fund scheme.

This calculator will calculate expected wealth gain and expected returns on investments made through SIP in any mutual fund scheme, based on a projected annual return rate.

Experts state that SIPs are a more lucrative mode of investing in mutual funds as compared to a lump sum amount. It helps you achieve financial discipline and create a habit of savings that can benefit you in the future.

A few of the benefits of SIP calculators include –

- Assists you to determine the amount you want to invest

- Tells you the total invested amount

- Gives an estimated value of the returns

A SIP plan calculator works on the following formula –

M = P × ({[1 + i]^n – 1} / i) × (1 + i)

In the above formula –

- M is the amount you receive upon maturity.

- P is the amount you invest at regular intervals.

- n is the number of payments you have made.

- i is the periodic rate of interest.

Take for example you want to invest Rs. 1,000 per month for 12 months at a periodic rate of interest of 12%.

then the monthly rate of return will be 12%/12 = 1/100=0.01

Hence, M = 1,000X ({[1 +0.01 ]^{12} – 1} / 0.01) x (1 + 0.01)

which gives Rs 12,809 Rs approximately in a year.

The rate of interest on an SIP will differ as per market conditions and may increase or decrease, which will change the estimated returns.

Our SIP amount calculator is very easy to use.

Our SIP amount calculator is very easy to use.

- Just enter the monthly amount to invest (the amount for which you have started the SIP)

- The number of years for which you want to stay invested

- The expected rate of return.

As soon as you input the values, the calculator will show you the estimated returns you can avail for your selected investment tenure.

Remember that while is it commendable to do your own research and start selecting funds, its also a great idea to talk to a well known financial expert to get well researched insights on investment opportunities that best align with and help achieve your financial goals.

Disclaimer:

These financial calculators are provided solely for informational and educational purposes. The results generated are hypothetical and based on user-input assumptions. They do not constitute investment advice, financial planning, or a recommendation to buy, sell, or hold any security or financial product.

Users are advised to consult with a qualified financial advisor or tax professional before making any investment decisions. JM Financial Services Limited (JMFS) makes no representations or warranties regarding the accuracy, completeness, or applicability of the calculator outputs to individual financial circumstances.

Past performance is not indicative of future results. JMFS, its affiliates/associates and any of its directors, officers, employees and any other persons associated with this shall not be liable for any loss, damage of any nature, including but not limited to direct, indirect, punitive, special, exemplary, consequential, market fluctuations, tax implications, or changes in regulatory frameworks, as also any loss of profit or damages in any way arising from reliance on the calculator results.

Use of these tools implies acceptance of this disclaimer and acknowledgment that all investment decisions are made at the user's own risk.

- PAN Card

- Cancelled Cheque

- Latest 6 month Bank Statement (Only for Derivatives Trading)

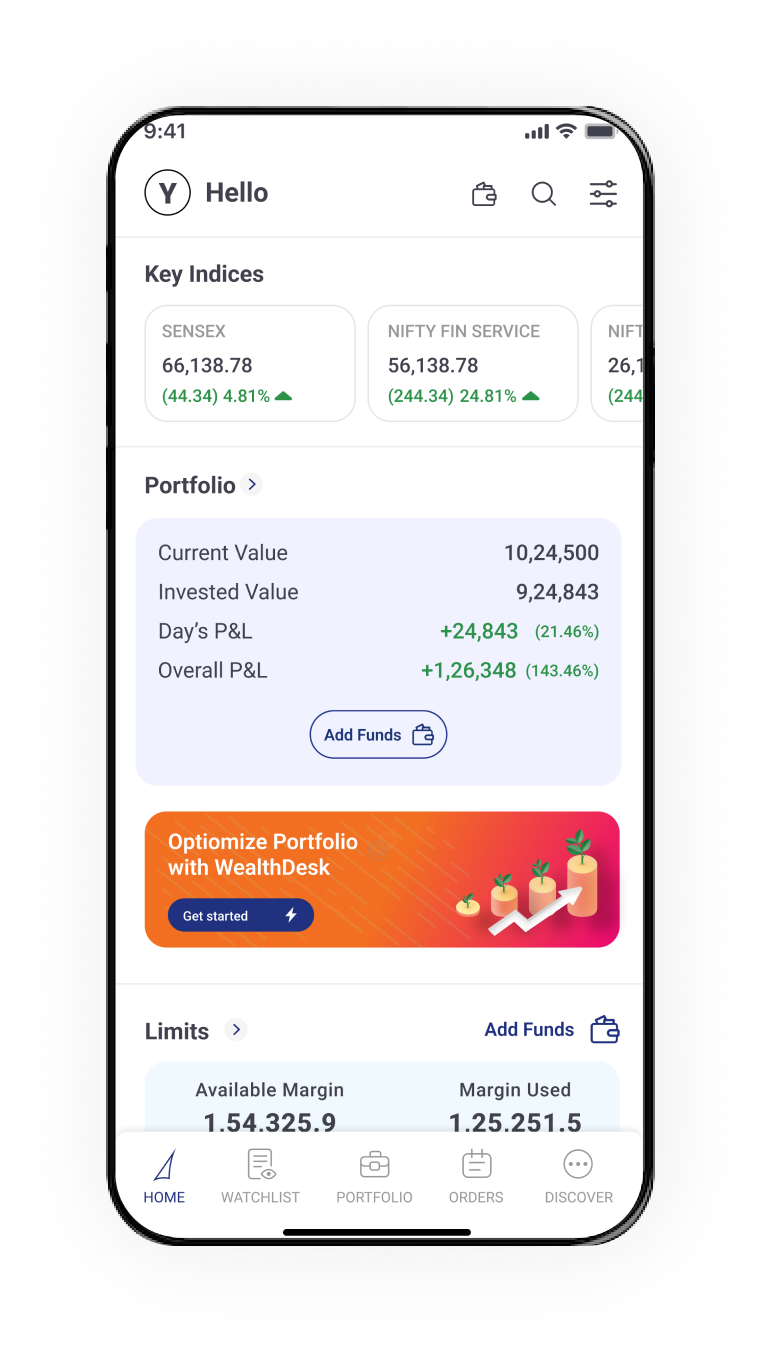

Dashboard

Watchlist

Slicing

Now