Open A Free Demat Account Today

Get StartedDocuments To Be Kept Handy

- PAN Card

- Cancelled Cheque

- Latest 6 month Bank Statement (Only for Derivatives Trading)

Stock Lending & Borrowing Scheme (SLBS)

Generate Additional Income

Multiple Options Available

Monitored By NSCL

- Stock Lending & Borrowing Scheme (SLBS) -

With Stock Lending and Borrowing Scheme investors can lend their stocks, for a fee, to traders who wish to short-sell them. Lenders can earn some additional income and borrowers fulfil their trading, financing or settlement needs. SLBS is regulated by SEBI in India and requires an agreement between the lender and borrower, specifying the terms and conditions of the transaction.

- Advantages of SLBS -

Helps generate additional income from an idle portfolio

Multiple securities on which derivatives are available in the F&O segment

Enables short sell in case of a bearish view on a stock

No counter party risk as transactions are guaranteed by NSCL

Avoids hassle of physical settlement

- How to start SLBS with JM Financial Services -

- Fill up the KYC form and get registered as client with JM Financial Services

- Read and understand the rights and obligations document for SLB Segment

- Place the lending order on Order Matching Platform of the exchange.

- On order execution, do an Early Pay-in (EPI) on or before the closure of the market hours on T-Day itself.

- Receive Lending fee on Securities pay-in on T+1 basis.

- Reverse leg settlement is carried out on the first Thursday of the subsequent month.

- The securities are returned to the lender upon receipt of the same from “Approved Intermediary" (AI) with SEBI.

- If the borrower fails to deliver the securities, AI conducts a buy‐in auction to acquire the securities to deliver to the Lender

- If securities are not available in auction then the transaction is closed out at the close out rate i.e. higher rate

- Key points about SLBS -

- Investor remains the beneficial owner of their securities and will be entitled to all corporate benefits like Dividends and Stock Splits

- The Lender will receive a lending fee, which will be determined by market (Demand and Supply for the securities)

- The Lender has “Early Recall*” facility in case he needs securities back before the Reverse leg settlement date. (*Subject to cost and availability of interested repaying borrower.)

- Securities Transaction Tax and SEBI Turnover Fees are not applicable

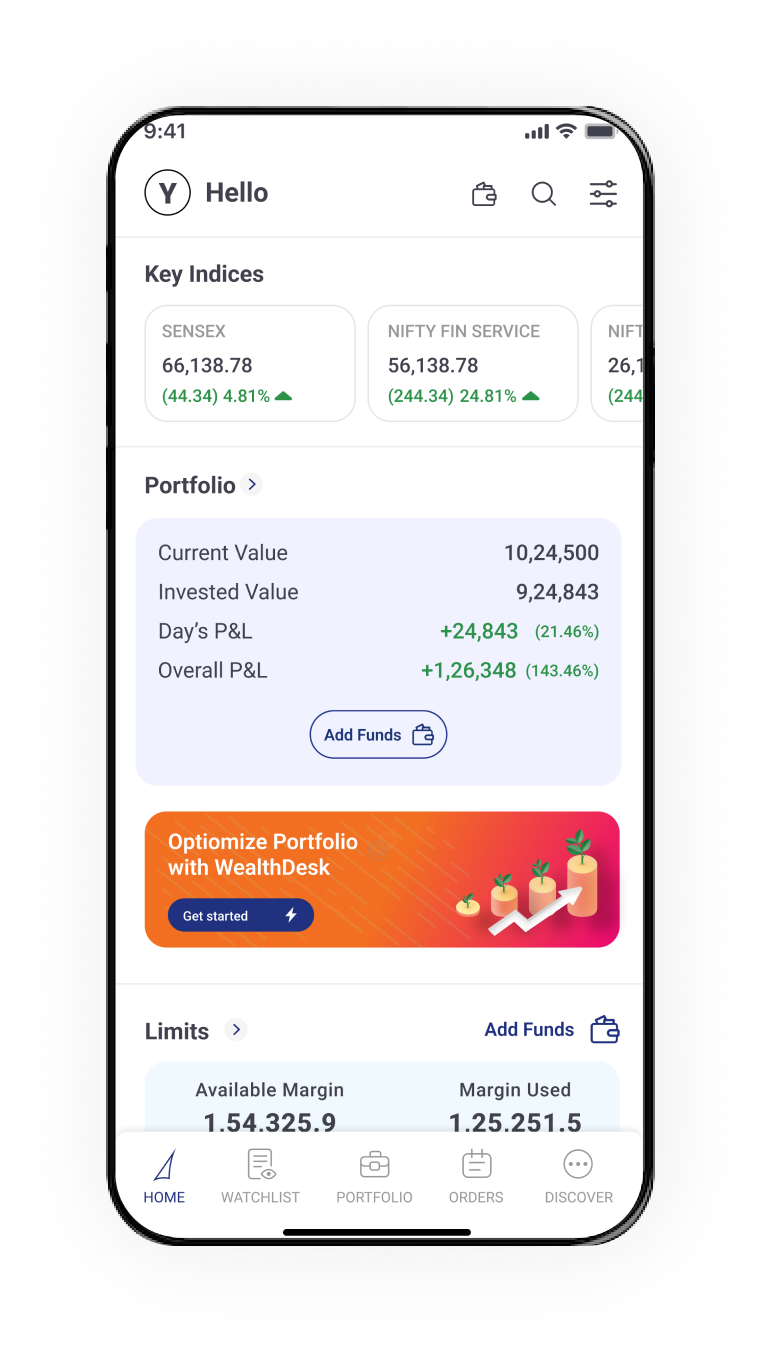

Pro-Code to Investing

Customised

Dashboard

Dashboard

Smart

Watchlist

Watchlist

Option

Slicing

Slicing

Download Now

Download

Now

Now

- Our Customers Love Us -

- Frequently Asked Questions -

Account Opening Terms & Conditions

- The Free Demat & Broking Account ("Welcome Offer") is being offered by JM Financial Services Ltd. ("JMFS") to new clients.

- *Tariff Structure for DP Services will be applicable as per the scheme/plan opted for.

- Execution of trades shall be governed as per the Terms and Conditions and KYC policies and Procedures agreed at the time of account opening and as amended from time to time.

- The Welcome Offer is not available/applicable to any employee of JM Financial Group and Business Affiliates ("Franchisees") of JMFS and the clients who are opening account with JMFS through their Franchisees.

- The Welcome Offer is subject to terms and condition as prescribed by JMFS. Please read the same carefully before opting for the Welcome Offer.

- JMFS reserve the rights to modify/amend the welcome Offer and its terms and conditions or withdraw the Welcome Offer at any time before the completion of the validity period by giving 15 days’ notice and the same shall be binding on the client.

- The brokerage will not exceed the SEBI prescribed limit.

- Demat cum trading account with JMFS will be opened after all the procedures relating to IPV and client due diligence are completed.

- In case of any dispute, the decision of JMFS management shall be final and binding on all the parties concerned.

- The above information is only for consumption by the client and such material should not be redistributed.

Investments in securities Market are subject to market risk, read all the related documents carefully before investing.

Declaration

- I understand that my account would be opened as per name appearing in Income Tax records and the same would be activated after all procedure relating to client due diligence in accordance with regulatory guidelines is completed.

- I authorize JMFS to contact me and send promotional communication via SMS & Whatsapp even though I may be registered under National Do Not Call Registry established under the Telecom Unsolicited Commercial Communications Regulations, 2007 or registered or may be registered under the National Customer Preference Register established under new regulations viz. the Telecom Commercial Communications Customer Preference Regulations, 2010.

- I authorize JMFS to undertake my KYC online through KRA/Aadhaar/Digi locker based on authentication of opening Trading and Demat account with JMFS.