Inflation Calculator

We need ₹ 42,494 , to buy the same item/achieve the goal in 2046

Let the glimpse of the future not frighten you, your preparedness will sail you through.

Let’s say last year the price of your favourite vegetable was Rs. 50 per kilo. At that price, Rs. 150 would get you 3 kg of vegetables. The price of that vegetable now increases to Rs. 75 a kg. Your Rs. 150 would be good enough for just 2 kg. So, you will have to shell out a further Rs. 75 to be able to afford 3 kg. Now assume that the prices of all the goods and services you use (food, rent, commuting, travel, entertainment) have increased. That will start making a big hole in your budget. If your income, either through your investments or earnings, does not increase faster than inflation, you will have less and less money to afford the things you want.

The causes of inflation are many and complex, including money supply, demand and supply of goods and services, the state of the economy, global factors, government policies, and a host of other factors.

The inflation rate is expressed as a percentage, and global governments use a variety of policies and measures to keep inflation within a range.

In India, Inflation is calculated using two indices: Consumer Price Index (CPI) and the Wholesale Price Index (WPI). In this article, we are looking only at first – CPI. The Consumer Price Index is based on the retail price of a basket of goods and services that, typically, most Indian households would consume. Currently, the CPI includes 260 commodities and services. The formula to calculate the rate of inflation is as follows:

Inflation may be a word that economists love to use. But it impacts the quality of our lives, our investments, our expenses, and the value of our money. Over time, inflation can deeply impact our financial goals if we do not plan for it.

- Reduces purchasing power

Inflation impacts purchasing power in a big way. The exact amount of money will buy you fewer goods as inflation rises. You will either consume less or spend more to maintain your lifestyle. - Impacts living standards

When prices rise and wages do not increase yearly by the same percentage or level, there is a gap between affordability and expenditure. Inflation, therefore almost always impacts the living standards of citizens as they can now purchase lesser things in the same amount of money. - Impacts investments and investment gains

Inflation has a deep impact on your investments. Assume you earn a post-tax return of 4% on your investments. Now, also assume that the inflation rate is 5%. In this case, your investments will be less and less with each passing year. That is why it is important to make investments that beat inflation.

In India, the inflation rate has been stable over the past few decades. In the 1990s, inflation in India averaged 9.5% and stabilised in the early 2000s as economic growth kicked in. India saw peak inflation in 1974, with a rate of 28.6%. Since 2020, the highest monthly inflation seen so far was in March 2022, which was 6.95%. Inflation in India has sometimes even slipped into the sub-zero territory.

The inflation range for the past 6 years is given below:

The Reserve Bank of India is mandated with maintaining inflation levels within the range of 2% and 6%, with 4% being the ideal target. RBI uses a variety of monetary policies to manage inflation levels.

Inflation is a by-product of a fast-growing economy. At an individual level, one of the best ways to counter inflation is to invest in assets that beat inflation. An inflation calculator shows your future spending power and the investments you must make to begin your inflation-beating investment journey.

While beating inflation is an important goal, keep your risk appetite, time horizon, and financial goals in mind. A well-diversified portfolio with a good mix of assets is an excellent way to plan your investments.

Here are some assets that you may consider:

- Direct stock investment, as equity tends to deliver inflation-beating returns over the long term

- SIPs in mutual funds are a good way to reduce risk and maintain investment discipline. Good mutual funds also tend to deliver better returns than the rate of inflation

- Gold is considered a good hedge against inflation and a store of value. You can consider Gold Exchange Traded Funds (ETFs) or sovereign gold to include the yellow metal in your portfolio.

- Good quality, tax-efficient debt instruments also deserve a place in your portfolio

An inflation calculator is a tool that projects how inflation will eat into your future wealth and what you can do in terms of investments to protect it. With the help of this inflation rate calculator, you can take a more informed decision on where and how you should invest. No matter what investment or asset you choose, our inflation adjustment calculator will show you the worth of your investments after adjusting the inflation rate in India.

How will the inflation calculator help you? You can use it to decide on the composition of assets in your portfolio. If you expect inflation to be higher going forward, you will need to earn higher returns. This means, you may have to increase your risk appetite. The inflation rate calculator will give you a realistic view of what you need to do.

How to use the inflation calculator?

- Enter the required details in the calculator, including the amount, the year you want the results for, and the comparable year

- Ensure that the information is correctly entered

- Press ‘estimate return’. That’s it.

- The calculator shows your future spending power and the value of the amount you invested, adjusted for inflation.

Are you ready to start your financial planning journey with the help of the inflation rate calculator?

Disclaimer:

These financial calculators are provided solely for informational and educational purposes. The results generated are hypothetical and based on user-input assumptions. They do not constitute investment advice, financial planning, or a recommendation to buy, sell, or hold any security or financial product.

Users are advised to consult with a qualified financial advisor or tax professional before making any investment decisions. JM Financial Services Limited (JMFS) makes no representations or warranties regarding the accuracy, completeness, or applicability of the calculator outputs to individual financial circumstances.

Past performance is not indicative of future results. JMFS, its affiliates/associates and any of its directors, officers, employees and any other persons associated with this shall not be liable for any loss, damage of any nature, including but not limited to direct, indirect, punitive, special, exemplary, consequential, market fluctuations, tax implications, or changes in regulatory frameworks, as also any loss of profit or damages in any way arising from reliance on the calculator results.

Use of these tools implies acceptance of this disclaimer and acknowledgment that all investment decisions are made at the user's own risk.

- PAN Card

- Cancelled Cheque

- Latest 6 month Bank Statement (Only for Derivatives Trading)

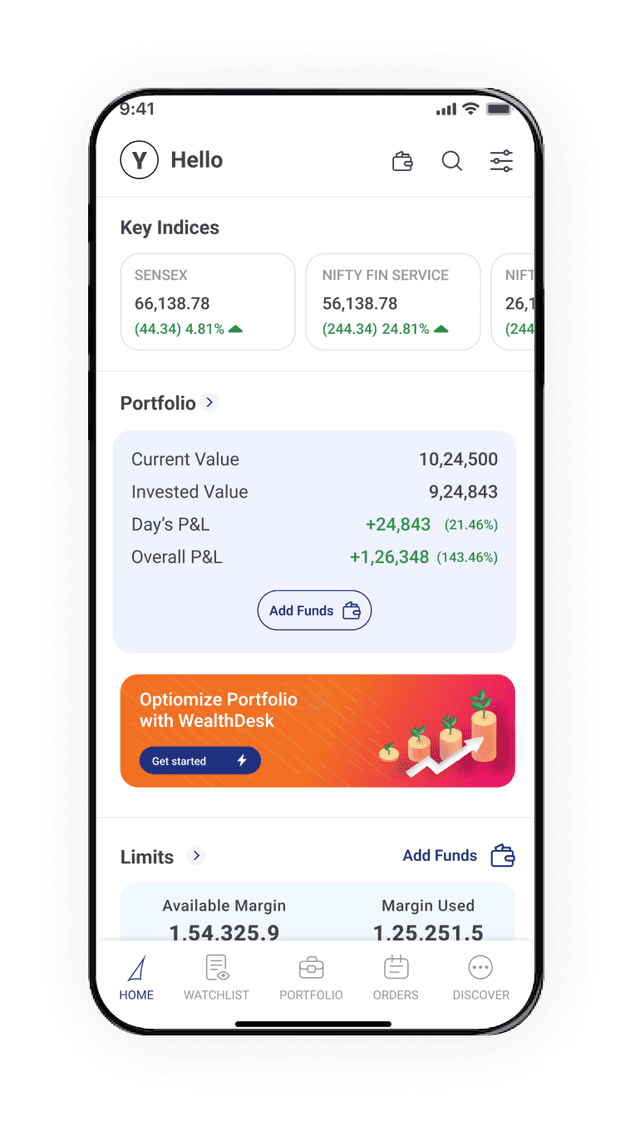

Dashboard

Watchlist

Slicing

Now