India’s CRDMO Sector: Growth Potential, Global Impact & Investment Insights

India is quickly becoming a global contract research and manufacturing hub. By 2028, the nation’s CRDMO industry is expected to double from FY23, potentially reaching $14 billion USD, with a projected 14% CAGR—far outpacing the global average. Indian CRDMO companies are gaining attention from Big Pharma, thanks to cost leadership, trusted partnerships, and the global pivot toward supply chain diversification beyond China

Understanding the CRDMO Sector

CRDMOs combine the niche research focus of CROs (Contract Research Organizations) and the manufacturing might of CDMOs (Contract Development & Manufacturing Organizations). They support pharmaceutical innovators throughout the drug development pipeline—right from discovery through clinical trials to large-scale commercial production.

India is fast emerging as a global manufacturing destination. CRDMO companies – which are

integrated CRO and CDMO companies – in India are riding multiple tailwinds such as

China+1, revival in biotech funding, cost leadership, etc., which is increasingly attracting Big

Pharma companies. The Indian industry is poised for revival.

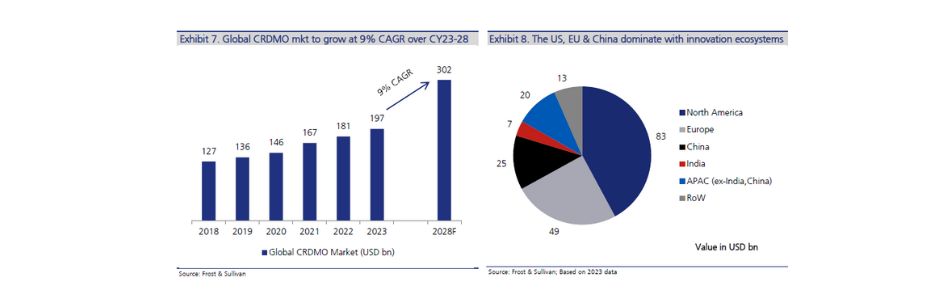

The global CRDMO industry is projected to grow at 9.1% CAGR over 2023-28 from USD

197bn to USD 302bn (Source: Frost & Sullivan). North America (mainly US), Europe

(Switzerland) and China dominate the global CRDMO landscape, with 42%/25%/13% global

market share respectively. In comparison, India has 3.6% market share, i.e., one-fourth that

of China. Despite the absence of an innovation ecosystem in India, the Indian CRDMO

industry will potentially double in size over the next 5 years.

Sector Tailwinds Fueling Growth

1. R&D Outsourcing Expands

Outsourcing R&D is accelerating globally as drug discovery becomes costlier and more complex. Penetration is set to rise to 46.6% by 2028, with constraints on biotech and small pharma companies encouraging them to use third-party partners.

2. China+1 Supply Chain Strategy

Geopolitical shifts, plus the US Biosecure Act, are prompting global firms to reduce reliance on China. India’s cost advantage (30-40% over Western peers) and compliance record (USFDA, EMA approvals) position it as a strategic alternative.

3. Biotech Funding Revival

Biotech funding, especially in the US, rebounded after a pandemic dip. Renewed investment means more discovery projects—benefiting Indian CRDMOs with deep expertise in small molecules.

4. India Rises as Preferred CRDMO Destination

- India’s current share: 3.6% (USD $7 billion)—only a quarter the size of China’s market share but poised to double by 2028.

- Key strengths: Trusted relationships with Big Pharma, world-class plants, and cost leadership.

- Main challenge: The innovation ecosystem remains underdeveloped compared to the US/EU.

Market Size & Global Landscape

- Global CRDMO market: USD $197 billion (2023), growing to USD $302 billion by 2028 (9.1% CAGR).

- Regional leaders: US (42%), EU (25%), China (13%), India (3.6%).

- India is expected to hit USD $14 billion (double FY23), benefiting from outsourcing, compliance, and capacity expansion.

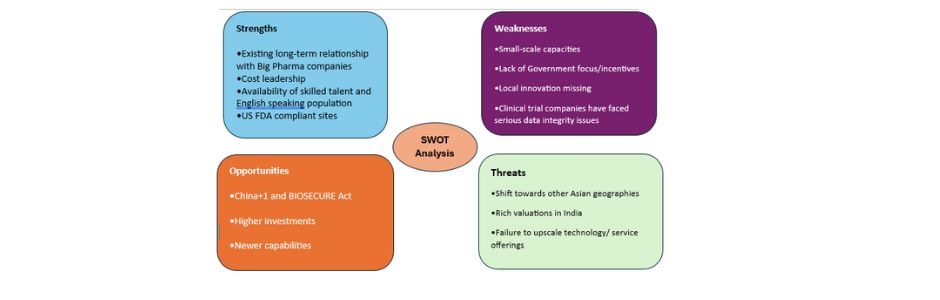

SWOT Analysis :-

India’s Key CRDMO Players & Investment Perspective

Top Indian CRDMOs

- Divis Laboratories

- Suven Pharma

- Piramal Pharma

- Syngene International

- Laurus Labs

- Neuland Labs

Spotlight: Piramal Pharma

Piramal Pharma’s CDMO division stands out with a 30:70 CRO:CDMO mix, manufacturing presence in the US/UK/India, commercial capabilities across intermediates, APIs, and formulations, and a robust pipeline (including a $100mn+ asset). The business is expected to post 17%+ CAGR over three years, driven by Phase III projects and commercialization momentum.

Piramal Pharma operates through three business verticals: (1) Contract Development and

Manufacturing Organisation (CDMO) - Piramal Pharma Solutions, offering development and

manufacturing in areas like highly potent APIs, ADCs, peptides, sterile injectables, and

hormonal products; (2) Complex Hospital Generics (CHG) - Piramal Critical Care, focused on

complex hospital generics in inhalation anaesthesia, injectable anaesthesia, pain

management, intrathecal therapy, and other injectables; and (3) India Consumer Healthcare

(ICH) - markets popular OTC brands such as Little's, Lacto Calamine, and I-Pill.

JM Financial Services recommends a BUY on Piramal Pharma with a target price of ₹295, citing strong revenue visibility, robust manufacturing infrastructure, and a healthy order book.

How JM Financial Services Adds Value

JM Financial Services offers deep sector research, expert advisory on CRDMO trends, actionable investment ideas, and portfolio support for investors seeking pharma exposure.

FAQs

Q1. Why is India’s CRDMO sector growing so fast?

Cost leadership, supply chain diversification, and increasing global R&D outsourcing are fueling the sector’s growth.

Q2. What’s the role of “China+1” in this growth?

Global pharmaceutical companies are looking beyond China, increasingly favoring India for manufacturing and research partnerships.

Q3. Which Indian company is a top CRDMO investment?

Piramal Pharma stands out for its global footprint, deep pipeline, and integrated CRDMO model—JM Financial rates it a BUY.

Q4. Will India’s innovation gap hold back its market share?

While innovation remains a challenge, strong partnerships with global pharma, robust compliance, and supply chain shifts are driving growth.

Q5. How can investors capitalize on this CRDMO boom?

By following expert guidance and actionable research from JM Financial Services, investors can identify key beneficiaries as the sector accelerates.

- PAN Card

- Cancelled Cheque

- Latest 6 month Bank Statement (Only for Derivatives Trading)